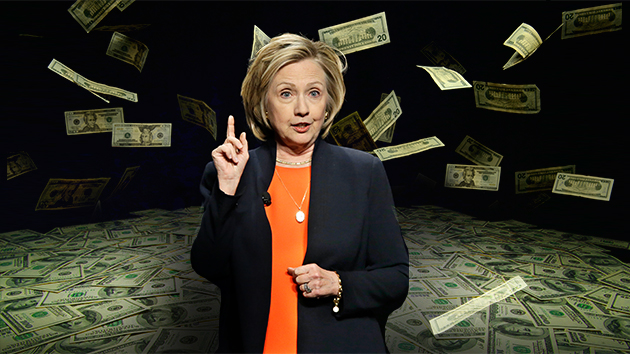

Hillary promises a trillion dollars in new taxes if elected

Not to be outdone by Bernie Sanders in promising free stuff to voters, Hillary Clinton is promising to raise taxes by an astounding trillion dollars. [Update: that is a ten year total, not per year.] Taking that kind money out of the economy and putting it into the hands of government bureaucrats will tank the economy. But of course, with so many members of the voting pubic not paying income taxes, this may actually be an attractive proposition to them.

Not to be outdone by Bernie Sanders in promising free stuff to voters, Hillary Clinton is promising to raise taxes by an astounding trillion dollars. [Update: that is a ten year total, not per year.] Taking that kind money out of the economy and putting it into the hands of government bureaucrats will tank the economy. But of course, with so many members of the voting pubic not paying income taxes, this may actually be an attractive proposition to them.

In a interview with the New York Daily News editorial board, she proposed (as the Daily Caller summarizes):

The former secretary of state proposed a slew of new hikes – including a 28 percent cap on itemized deductions to raise $350 billion for college subsides. Through “business tax reform,” she said she plans to bring in $275 billion for infrastructure purposes and plans to raise somewhere between $400 and $500 billion in revenue by eliminating certain deductions, raising the estate tax, capital gains tax and implementing the “Buffett Rule,” meaning anyone making over $1 million a year will face at least a 30 percent tax rate.

Capping deductions at 28% of income will cause many sole proprietorships, typically the smallest of small businesses, to go out of business. This penalizes the poorly capitalized small businesses that cannot afford the lawyers (and often the corporate taxes – California charges a tax of $500 a year for the privilege of being a corporation) who must subtract supplies, hired labor, and other “deductions” from their gross income. Hillary would kneecap the bottom rungs of the ladder of entrepreneurship this way. But with five shell companies in Delaware, protected by secrecy laws that rival Panama, Hillary has no understanding of the little guys or gals who want to start out as their own biss with as little overhead as possible.

Capping deductions at 28% of income will cause many sole proprietorships, typically the smallest of small businesses, to go out of business. This penalizes the poorly capitalized small businesses that cannot afford the lawyers (and often the corporate taxes – California charges a tax of $500 a year for the privilege of being a corporation) who must subtract supplies, hired labor, and other “deductions” from their gross income. Hillary would kneecap the bottom rungs of the ladder of entrepreneurship this way. But with five shell companies in Delaware, protected by secrecy laws that rival Panama, Hillary has no understanding of the little guys or gals who want to start out as their own biss with as little overhead as possible.

The deduction limit would also torpedo large gifts to charity.

As for hiking estate taxes, that will be a full employment act for lawyers and tax consultants, who will generate lots of income gaming the system. And high capital gains taxes penalize investment in job creation.

Just what we need as the percentage of the population employed is falling to historic lows since the mass introduction of women into the labor force.