The Trump brand, supposedly synonymous with giving customers nothing but the best, is now attached to a health care plan that, in one critical respect, is by far the stingiest of any GOP plan on the table.

The Trump brand, supposedly synonymous with giving customers nothing but the best, is now attached to a health care plan that, in one critical respect, is by far the stingiest of any GOP plan on the table.

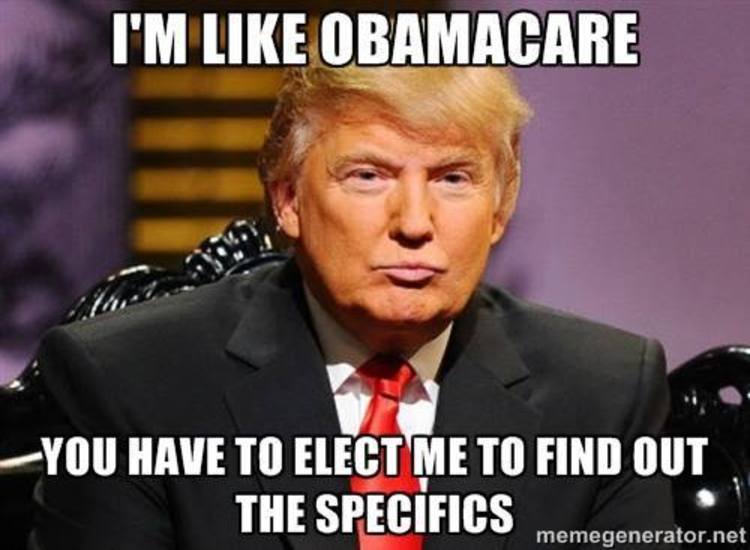

At the final debate before Super Tuesday, Donald Trump made little sense talking about health care, repeating several times that he wouldn’t let people die in the streets and that he would open state insurance markets to outside competitors. One week later, it’s probably unrealistic to expect the “Healthcare Reform To Make America Great Again” sketched out on his website to ace the test, and the plan is presented as a work in progress, not a final product.

Yet the details offered, particularly those related to the individual insurance market that would exist after he kills off the ObamaCare exchanges, reveal in multiple ways that Trump’s campaign has little idea what it is talking about.

Unlike ObamaCare, which makes its subsidies much more valuable for lower earners, all recent GOP plans offer the same size tax credit for lower earners and higher earners, only raising the level of subsidy based on age to partially make up for the higher premiums charged to older adults.

Although these GOP plans offer a much better deal than ObamaCare to people with moderate incomes, they are vulnerable to criticism because they would make it harder for lower earners to afford an appropriate level of insurance.

Smaller Subsidies To Working Class

But TrumpCare presents an even bigger target for criticism because it would provide its smallest subsidies to lower earners, raising the level of tax subsidy as income rises. That’s because Trump’s plan, instead of offering a flat tax credit, would make premiums tax deductible for people buying coverage in the individual market. Like the current tax exclusion for coverage bought through an employer, this would have the effect of giving bigger subsidies to households in higher tax brackets.

Consider how the Trump plan stacks up against other GOP plans in terms of what it would provide to a 64-year-old couple earning about $24,000, or 150% of the poverty level. The Patient Care Act, from Rep. Fred Upton and Sens. Richard Burr and Orrin Hatch, would provide a $9,380 subsidy to this couple. The Empowering Patients First Act authored by Rep. Tom Price would provide a $6,000 subsidy. But the Trump tax deduction would provide, at most, about $4,000, assuming people get a break on the payroll taxes paid by themselves and their employer.

How would the Trump plan stack up against ObamaCare? The same $1,000- deductible silver plan that costs roughly $1,000 for a 64-year-old couple at 150% of the poverty level under ObamaCare would cost them about $20,000, or 80% of income, under Trump’s plan. Try defending that in a debate against Hillary Clinton.

The shock is that Trump has spoken approvingly of countries with single-payer systems, earning him the criticism of his GOP rivals, but his plan offers the barest of bones for modest-income individuals and families.

The Trump plan also would create an incentive for higher earners to buy more expensive plans, because the tax deduction under his approach would grow as premium payments rise. This feature is one of the aspects of the employer-provided system that economists hate most because it greases the path for higher health care spending.

While Trump’s healthcare plan throws in an idea, also embraced by Clinton, to allow importation of prescription drugs, this isn’t the kind of game changer that would dramatically reduce the cost of insurance. The details sketched out didn’t include his earlier call for allowing Medicare to negotiate with drug companies. The website also had no mention of Trump’s recent call to keep ObamaCare’s regulation that requires insurers to offer people coverage on the same terms, even if they wait until they’re sick to enroll.

In fact the outlines of the plan are so different from the tone of Trump’s earlier statements that policy wonks discussing the plan on Twitter were skeptical that the details really reflected the candidate’s thinking.

The most important thing about Donald Trump’s health care plan is that Trump didn’t write it: https://t.co/NssGqHdo2n

— Avik Roy (@Avik) March 3, 2016

Trump’s health care plan certainly doesn’t seem to be consistent with his tax plan, under which about two-thirds of households would have no income-tax liability.

http://www.investors.com/politics/capital-hill/trumpcare-delivers-a-shock-to-the-working-class/