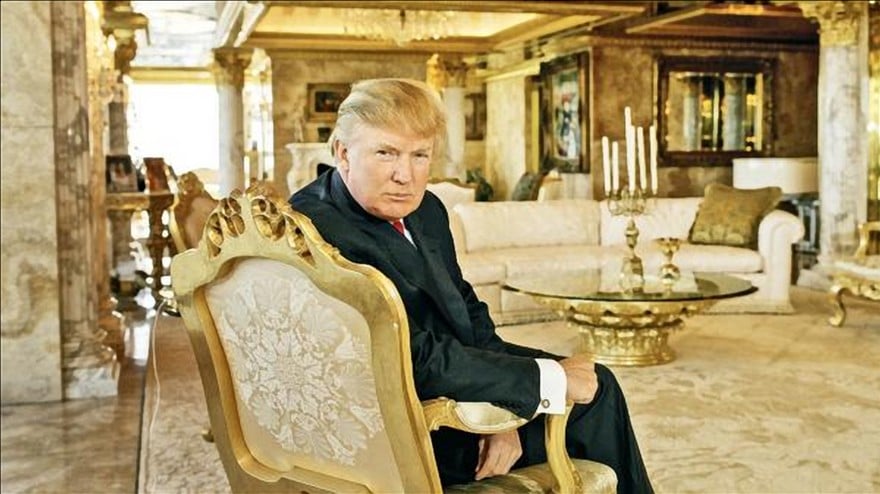

NYT: Trump Used Now-Illegal Tax Maneuver in 1990s to Avoid Taxes

Donald Trump avoided paying taxes in the early 1990s by using a maneuver that was frowned upon and would have likely been overruled by the IRS in an audit, according to a new report.

Donald Trump avoided paying taxes in the early 1990s by using a maneuver that was frowned upon and would have likely been overruled by the IRS in an audit, according to a new report.

The New York Times cites letters from Trump’s tax lawyers and documents from the bankruptcy filings of Trump’s three Atlantic City casinos.

The report claims Trump, the Republican presidential nominee, pressured his debtors to cancel the debt he owed to them stemming from their investment in the casinos. Trump would have been on the hook to pay tax on that forgiven debt, but he swapped the amount to make it appear it had been paid off.

Trump, the Times noted, could have saved tens of millions of dollars with this “stock-for-debt swap” maneuver. The website also reported Trump had merely a few million dollars in his bank accounts during certain points in the early 1990s.

The maneuver was taken out of the U.S. tax code for corporations to use in 1993, but partnerships were allowed to use it until that was deemed illegal in 2004.

The Times obtained letters to Trump from tax strategists who expressed skepticism the maneuver would escape the IRS audit controls, although it is unclear if the agency audited Trump after he allegedly used the maneuver.

“He deducted somebody else’s losses,” John Buckley, the chief of staff for the Congressional Joint Committee on Taxation in 1993 and 1994, told the Times. “He is double dipping big time.”

Trump has refused to release his tax returns, making him the first major presidential candidate not to do so in more than 40 years. The Times published part of his 1995 return in early October that showed he posted a staggering $916 million loss that year.

Trump admitted using deductions to lower his tax bill to zero for as many as 18 years, saying it was legal.

http://www.newsmax.com/Politics/tax-taxes-IRS-audit/2016/10/31/id/756283/